Investing Newsletter - Jan 2023

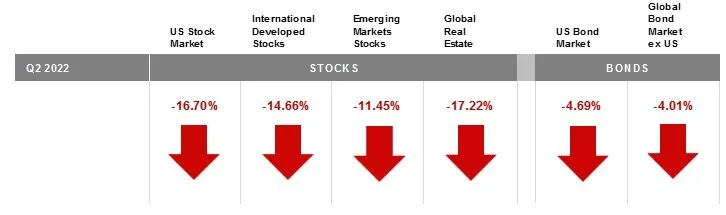

2022 was the seventh worst calendar year loss for the S&P 500 Index since the 1920s, down -18.1%.

The 13% drop in the Aggregate Bond Index for the year was over 10% greater than any other annual drop in this index’s history!

Since 1928, the S&P 500 Index has experienced two or more consecutive negative years just eight times.

Read More

How does the newly passed SECURE Act 2.0 affect your retirement?

The recently signed bill by President Joe Biden was a $1.7 trillion omnibus spending bill which includes Secure 2.0 Act retirement savings legislation. This landmark legislation includes many changes to retirement savings. Here’s a rundown of some key points that we think may have direct impact on your retirement saving strategies.

Read More

Should I use an AB Trust? Pros and Cons

We all learned our ABCs as kids, and the nice thing about the alphabet is that it never changes. This is not the case for the ABCs of estate planning - where things can and do change often, especially with structures such as AB Trusts.

Read More

California Residents – Keep an Eye out for the Middle Class Tax Refund

The Middle Class Tax Refund is a one-time tax refund payment for California residents who filed a 2020 tax return with an AGI (adjusted gross income line 17 of CA Form 540) of less than $250,000 (Individual) or less than $500,000 (Married or Head of Household).

Read More

Free Real Estate Fraud Protection is available in San Diego County

This blog discusses an exciting new development in the prevention of real estate fraud in San Diego County!

Read More

529 account mistakes: why selecting a successor owner is an important consideration

Many parents and grandparent establish 529 plan Education Savings Accounts for their children or grandchildren to help pay for future education expenses. 529 accounts are state sponsored investment plan accounts that offer tax free growth when the funds are used to pay for private K-12 or college expenses.

Read More

Financial Planning Tips for Small Business Owners

Being self-employed and owning a business provide many benefits but it can pose challenges for your personal finances. Here are some financial planning tips for small business owners to consider.

Read More

Is buying I Bonds a good idea? Here’s a balanced view.

With interest rates and inflation rising, a common question we are receiving is, “Should I be buying I Bonds right now?” We explore that question in this article.

Read More

Should you consider a Roth conversion in retirement?

Is a Roth conversion right for you during your retirement? There are a number of factors to consider.

Read More

What is the Californians For All College Corps, and is it worth it?

For California families with college age children, the Californians For All College Corps is an opportunity to teach financial responsibility and civic obligation to young adult children. This blog discusses what the College Corps program is, and if California families should consider getting their children involved.

Read More

How Russia Invading the Ukraine could Impact Your Portfolio

In recent months, the escalation of geopolitical threats (such as Russia invading the Ukraine, China threatening Taiwan, and the Iranian nuclear deal) may seem like an ominous cloud that is doomed to negatively impact stock market returns.

Read More