Our EXPERT Advisory Process® will empower you and your family to reach your financial goals and dreams.

We review key areas of your finances and deliver personalized advice and investment management that are coordinated with your CPA, attorney, and the rest of your professional team – giving you the clarity and confidence to focus on everything else you care about.

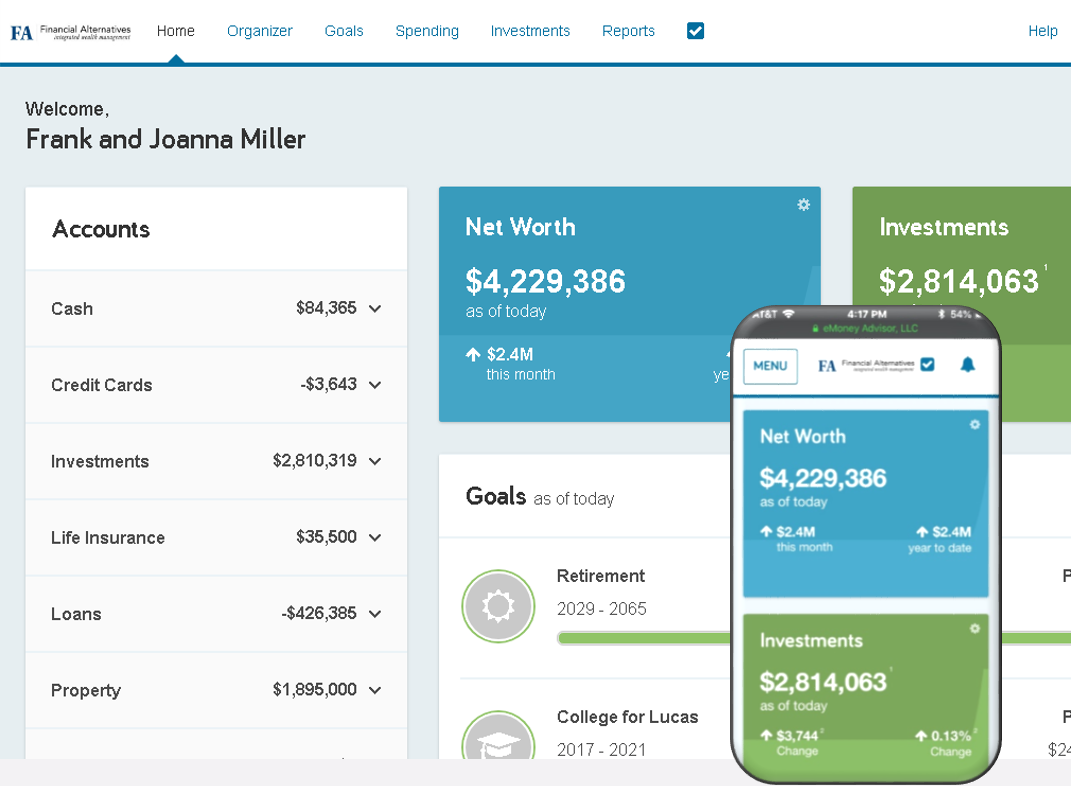

Through a series of meetings, financial tools, and ongoing services that we call our EXPERT Advisory Process®, we help you make Better Wealth Choices℠ for today and tomorrow.

Our EXPERT Process and corresponding Financial Tools can help you:

Stay on track to achieve your goals.

Manage risks by coordinating with insurance and legal professionals.

Communicate better with family on estate planning and other financial issues.

Properly manage your investments and other resources such as pensions and real estate.

Have a plan for life’s unexpected challenges.

Investment Approach

We design and maintain your investment portfolio to balance your needs for principal protection, income, and growth.

We strive to ensure investments will be tax efficient, low cost, and properly diversified to reduce risk and maximize return.

Using a disciplined and systematic investment process over multiple market cycles has lead us to favor investments from Vanguard and Dimensional Fund Advisors (DFA), as well as mortgage backed investments, commonly called private Trust Deeds.

We choose to work with investment firms that believe that avoiding unnecessary trading, management, sales, and tax costs is critical to preserving and growing your portfolio.

Book an appointment to discuss our portfolio management services or to receive a second opinion on your portfolio.

Fees

Our fees are simple and transparent.

We ordinarily charge based on a percentage of the value of your investment portfolio starting at 1% per year (please see the tiered rate table below). Based on the scope of services or other circumstances in your case, a minimum annual fee or customized arrangement may apply.

| Asset Value | Annual Rate |

|---|---|

| $0.00 – $2,000,000.00 | 1.00% |

| $2,000,000.01 – $5,000,000.00 | 0.80% |

| $5,000,000.01 – $10,000,000.00 | 0.60% |

| $10,000,000.01 and up | 0.40% |