Many parents and grandparent establish 529 plan Education Savings Accounts for their children or grandchildren to help pay for future education expenses. 529 accounts are state sponsored investment plan accounts that offer tax free growth when the funds are used to pay for private K-12 or college expenses.

Read More“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

Make sure you have enough cash and other conservative investments so you will never have to sell stocks in a bear market even a prolonged bear market.

Expect stock markets to fall further after you rebalance, in other words mentally prepare for this so you will not be overly bothered by it.

US mortgage rates hit 5% for first time since 2011.

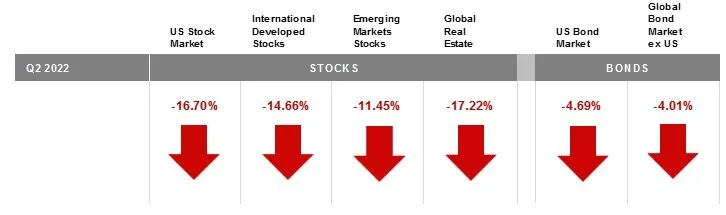

The US equity market posted negative returns for the quarter and underperformed both non-US developed and emerging markets.

The Bloomberg Commodity Index Total Return returned -5.66% for the second quarter of 2022.

While volatile periods like the one we’re experiencing now can be intense, investors who learn to embrace uncertainty may often triumph in the long run.

Emerging markets posted negative returns for the quarter, underperforming the US and non-US developed equity markets.

The US equity market posted negative returns for the quarter and underperformed non-US developed markets, but outperformed emerging markets.

The Bloomberg Commodity Index Total Return returned +25.55% for the first quarter of 2022.

Vanguard’s 10-year forecast for U.S. equity returns is 2.3% to 4.3% per year; and for global equities it’s higher at 5.2% to 7.2% per year.

Market corrections are a good time to rebalance your portfolio and add back to stock holdings.

History shows that reaching a new market high doesn’t mean the market will then retreat.

It is wise to have a plan in place for the possibility of reduced future investment returns.

Emerging markets fell 2.5% for the year, underperforming both US and non-US developed equity markets.

The Bloomberg Commodity Index Total Return returned -1.56% for the fourth quarter of 2021.

Interest rate movements in the US Treasury fixed income market were mixed during the fourth quarter.

The US equity market was flat for the quarter and outperformed non-US developed markets and emerging markets

In emerging and developed markets, most currencies depreciated vs. the US dollar

The Bloomberg Commodity Index Total Return returned 6.59% for the third quarter of 2021.

Staying diversified and disciplined, avoiding market timing, and maintaining a long-term investment perspective is a better course of action.

Market timing is the attempt to own stocks when they are rising, sell them high before they fall, and buy them back at lower prices before they rise again.

Understanding the history of bear markets and maintaining a long-term focus helps investors remain calm and take appropriate action during corrections.

Equity markets around the globe posted positive returns in the second quarter. Looking at broad market indices, US and non-US developed markets outperformed emerging markets for the quarter

Emerging markets posted positive returns for the quarter, underperforming the US and non-US developed equity markets.

In developed markets, several currencies appreciated vs. the US dollar, but some, notably the Australian dollar, depreciated. In emerging markets, most currencies appreciated vs. the US dollar, but some, notably the Turkish lira, depreciated.

The US equity market posted positive returns for the quarter and outperformed non-US developed markets and emerging markets.

US real estate investment trusts outperformed non-US REITs during the quarter.

The Bloomberg Commodity Index Total Return returned 6.92% for the first quarter of 2021

In the face of a global pandemic, stock and bond markets performed surprisingly well in 2020.

Last year investors experienced one of the swiftest drops and subsequent full recoveries in stock market history.

We took advantage of the correction and rebalanced portfolios in March when the market was low. We also took advantage of market lows by executing tax-saving tax swap trades.

Equity markets around the globe posted positive returns in the fourth quarter. Looking at broad market indices, emerging markets outperformed non-US developed markets and US equities.

REIT indices underperformed equity market indices in both the US and non-US developed markets.

The Bloomberg Commodity Index Total Return returned 10.19% for the fourth quarter of 2020.

Equity markets around the globe posted positive returns in the third quarter. Looking at broad market indices, emerging markets equities outperformed US and non-US developed markets for the quarter.

Value underperformed growth across regions. Small caps outperformed large caps in non-US developed and emerging markets but underperformed in the US.

REIT indices underperformed equity market indices in both the US and non-US developed markets.

The quarter ending March 31st was the 9th worst quarter of stock market performance; and the quarter ending June 30th was the 9th best.

Investors who swapped from stocks to cash after the steep drop in March missed the subsequent rebound.

We took measures in light of the situation by rebalancing client portfolios and executing tax swaps.

We are living through an unprecedented period of history and we expect markets to remain uncertain for some time to come.

Equity markets around the globe posted positive returns in the second quarter.

Looking at broad market indices, US equities outperformed non-US developed markets and emerging markets.

Value stocks underperformed growth stocks, and small caps outperformed large caps.

REIT indices underperformed equity market indices in both the US and non-US developed markets.

Equity markets around the globe posted negative returns in the first quarter.

Looking at broad market indices, US equities outperformed non-US developed markets and emerging markets.

Value stocks underperformed growth stocks in all regions. Small caps also underperformed large caps in all regions.

REIT indices underperformed equity market indices in both the US and non-US developed markets.

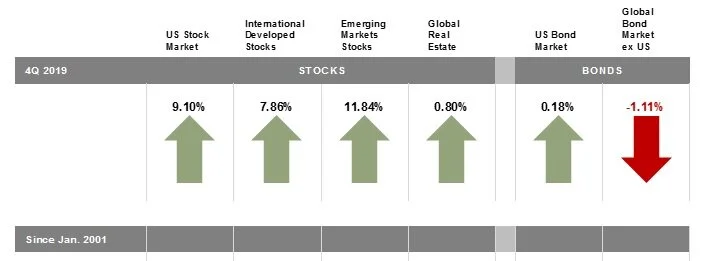

Equity markets around the globe posted positive returns in the fourth quarter. Looking at broad market indices, US equities outperformed non-US developed markets but underperformed emerging markets.

Value stocks underperformed growth stocks in all regions. Small caps outperformed large caps in the US and non-US developed markets but underperformed in emerging markets.

REIT indices underperformed equity market indices in both the US and non-US developed markets.

Stock and bond markets continued to rebound from the 2018 correction.

Asset classes can have very prolonged downturns like what happened with the S&P 500 during the “lost decade”.

Diversifying into other asset classes like emerging markets and small company stocks would have mitigated losses during the lost decade.

Just when investors begin to question the future viability of an asset class may be the point a reversal occurs— as what happened with