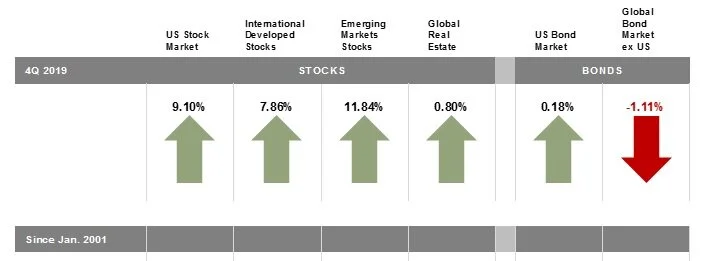

Equity markets around the globe posted positive returns in the fourth quarter. Looking at broad market indices, US equities outperformed non-US developed markets but underperformed emerging markets.

Value stocks underperformed growth stocks in all regions. Small caps outperformed large caps in the US and non-US developed markets but underperformed in emerging markets.

REIT indices underperformed equity market indices in both the US and non-US developed markets.