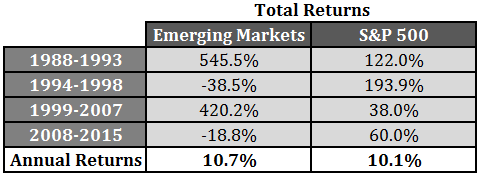

Emerging Markets vs The S&P 500

The below chart shows how much Emerging Market equities have underperformed the S&P 500 since the financial crisis. It also shows how these stretches of underperformance and outperformance are not unusual. The key to success in investing in Emerging Markets is to rebalance and add to positions during periods of underperformance and to rebalance and take profits during periods of outperformance. Having a dedicated allocation to Emerging Market equities and rebalancing back to this allocation systematically helps you accomplish this.

See the graph below to see what would have happened to returns if an investor had held a 50/50 portfolio of Emerging Markets and the S&P 500 and rebalanced it back to 50/50 at the end of each year during this period. As you can see the returns would have been 11.6% or 1.5% better than the S&P 500.

We normally allocate roughly 3% - 6% of a clients’ portfolio to Emerging Market equities. We use either the Vanguard Emerging Market fund or the DFA Emerging Market Core fund – both funds are highly diversified. The Vanguard fund holds 980 stocks and the DFA fund holds 3,807 stocks.

Many people believe Emerging Market equities will provide higher returns than the S&P 500 over the next market cycle due to their recent underperformance. We would not be surprised to see this happen since it is a well established pattern as the first graph illustrates. We plan to keep our clients’ allocation to Emerging Markets consistent and we will also do tax swaps to lock in losses that can be used to offset gains in other areas of their portfolios.

*The above graphs were taken from Ben Carlson’s blog, “A Wealth of Common Sense – Personal Finance, Investments & Markets”.