With Employer Stock in a Retirement Plan, Consider Net Unrealized Appreciation (NUA)

What is NUA?

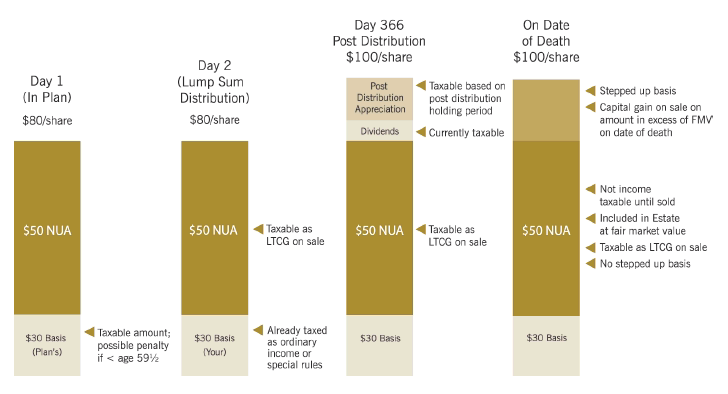

Net Unrealized Appreciation refers to the embedded gain you have in employer stock inside a retirement plan. For example, you may have paid $30k (“cost basis”) for stock over the course of your employment, but it is now worth $80k when you retire. The IRS allows for special tax treatment of the $50k gain in this stock.

The Basic Idea

When you leave employment, you have several choices. Often people will roll over all their funds into an IRA. If you do this, the rollover itself is not taxable; however, any withdrawals you make from the IRA are considered ordinary taxable income (35+% depending on your tax bracket).

If you follow the specific rules for NUA tax treatment, you will pay income tax based on the cost basis of your employer stock and put it in a brokerage account; the rest gets rolled over into an IRA – as described above. Now, you get long-term capital gain tax treatment (20%) if you sell the stock!

Not for Everyone

- Use highly appreciated stock – because you pay taxes on the cost basis of the NUA stock, the embedded gain should be significant to make this technique worthwhile.

- Consider stock valuation – if the stock is volatile or has the potential to drop significantly (e.g. Enron, WorldCom), the tax benefit could be wiped out by financial losses.

- Think about current and future tax rates – this technique makes more sense for those who expect to continue to be in a high tax bracket.

NUA Stock Illustration

Remember, you must follow specific rules to qualify for the NUA tax treatment, so be sure to work with your tax and financial advisors when using this technique.

Image Source: Smith Barney