High Income Individual? What you need to know about the One Big Beautiful Bill

On July 4th, 2025, President Trump signed into law the One Big Beautiful Bill Act (OBBBA), which was subsequently approved by Congress. This bill has many implications. In this blog we will discuss what it means for individuals of high net worth and people in the higher tax brackets. Such individuals will need to be more proactive with their tax planning in order to navigate the potential negative impacts.

Before we get started, we are fee-only financial advisors in California serving La Jolla and the surrounding communities as well as clients all over the country.

We’ve written about the following wealth management topics:

Insurance renewal and the LA Fires

Be sure to check them out! And now, let’s get onto the blog.

Changes on tax provisions for individuals

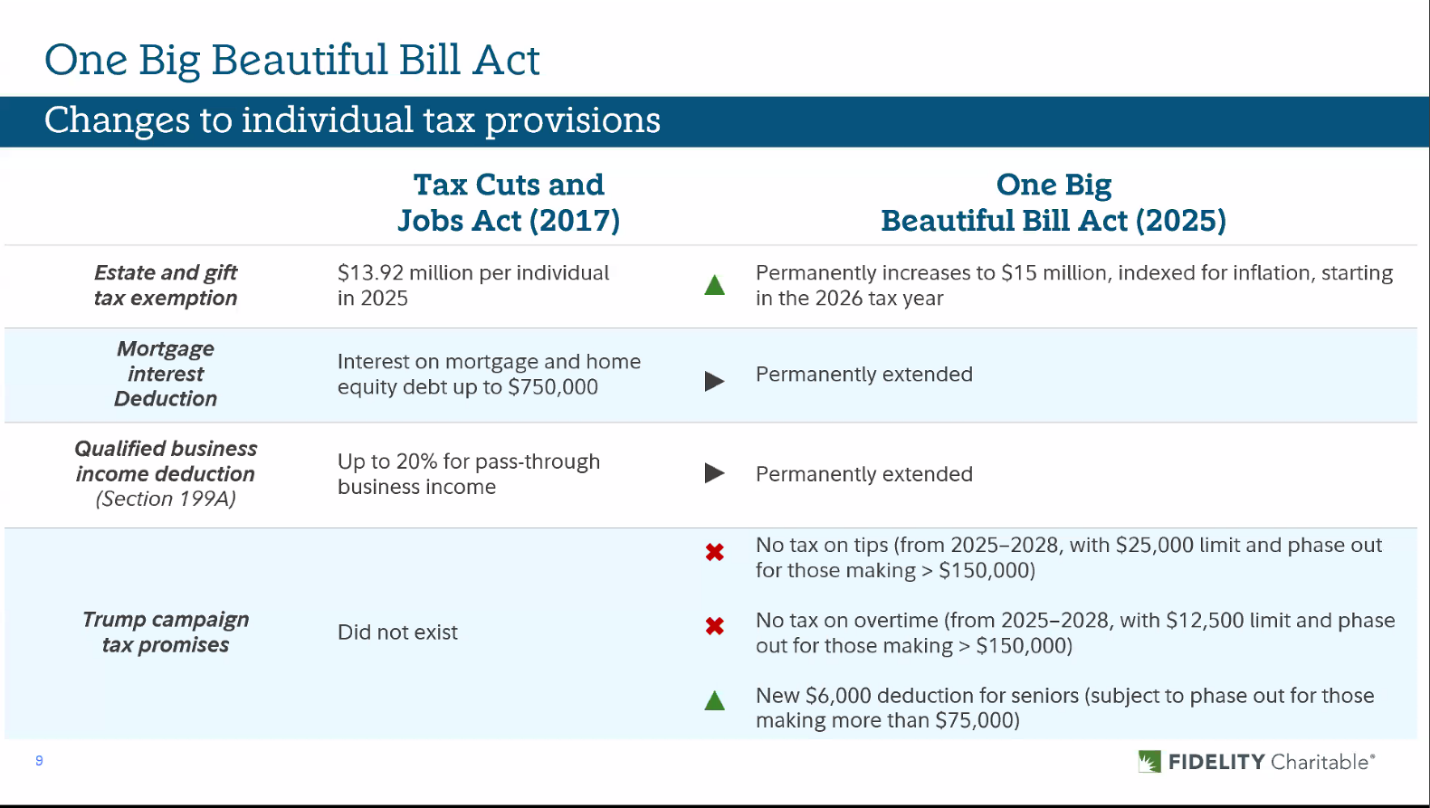

Under the Bill, the top marginal income tax rate of 37% becomes permanent (replacing the 39.6% rate that would have applied in 2026 without the Bill). Another big notable change is the state and local tax deduction cap is increased to $40,000 with phase out for higher taxable income. The estate and gift tax exemption is increased to $15 million.

This chart summarizes the major changes.

Source: Fidelity Charitable

Tax planning strategies for the high net worth

Here are some tax planning ideas that high net worth individuals should consider in light of the Big Beautiful Bill’s passing. Before you read on, please remember that we are not CPAs; for tax advice specific to your personal situation, consult with your tax or financial advisor.

Roth Conversions is still a good strategy: High net worth doesn’t always equal high income brackets. Depending on your personal tax situation, you may consider Roth conversions during income gap years or pre-RMD years. This will help you convert assets to “after-tax” buckets.

Itemize deductions is now more likely: With the SALT limit being higher, for most high income earners who own homes in states and cities with higher tax rates, you might start itemizing deducting again. Keep tabs on your medical expenses and mortgage interest. Also consider a “bunching” strategy for medical expenses and charitable donations. This involves grouping these items in certain years when your income is higher, in order to offset it.

High income subject to cap on itemized deduction: Starting in the tax year 2026, high-income taxpayers, particularly those in the top (37%) tax bracket, , itemized deductions are capped at 35%. This excludes the Qualified Business deduction. High net worth individuals should review their deductions before year end with their CPA in order to determine if it still makes sense to itemize. As an example, a $1 deduction provides a $0.35 tax benefit instead of $0.37. This will impact high-earning taxpayers in regards to their charitable contributions by reducing their benefit by 2%.

Higher estate and gift tax exemption:

Review your estate plan and discuss with your advisor to see if the lifetime gifting is desirable. You may be able to use up some of the lifetime gift exemption available to you, if applicable.

Utilize the annual gift exemption of $19,000 (for 2025) for family giftings. As a couple, you can gift $19,000 to your daughter, and another $19,000 to your son-in-law for a total of $38,000 per year without having to pay taxes. If you are married, you can combine the annual gift amount for a total of $76,000 per year!

Don’t forget that you can pay unlimited amounts directly to a school or medical provider on someone’s behalf without it counting as a gift. Speak to your Financial Advisor and CPA on the best way to utilize this.

Review your family trust to see if the trust structure is appropriate given the higher amount of estate tax exemption being made permanent. Many revocable trusts retain the A/B split structure at first death. This may or may not be necessary for tax purposes.

Charitable gifting strategies are more diversified: The passing of the bill highlights three strategies that one can use to optimize charitable giving:

Take advantage of the $1,000 Single/$2000 JF above- the-line deduction if you are just taking the standard deduction.

For those who do itemize deductions, remember there’s a new 0.5% floor, meaning the contributions are reduced by 0.5% of your AGI (Adjusted Gross Income). Consider donating low basis assets to a Donor Advised Fund to optimize this strategy.

For those over age 70, consider doing qualified charitable distributions from retirement accounts to avoid any AGI limitation or other restrictions.

Best baby shower gift- Trump account: The government will contribute $1,000 to this account for each child with a valid Social Security number born between Dec. 1, 2025 and Dec. 31, 2028. The earnings grow tax-deferred. Each year, the account may receive up to $5,000 in contributions (increasing annually for inflation). This is a better gift for your new grandchild than a baby shower basket!

Harvest capital gains: some of the deductions from this bill are only temporary. If it makes sense for your personal situation, harvest more gains in the portfolio to take advantage of these deductions now!

Utilize super catch up contribution for your 401K: If you are between age 60-63, you may be able to utilize a higher catch up contributions.

Conclusion

If you are in the 37% bracket, proactive tax planning is the key! You are subject to phaseout in itemized deductions as well as tax bracket inflation limitations.

We are financial advisors in La Jolla, California. If you want to discuss your overall financial plan or retiring in California or other locations, please reach out to us and set up a time to talk.

Ellen Li is a partner at Financial Alternatives and a lead advisor for many of the firm’s clients and has a special focus on financial planning. Ellen has an MSBA degree in Financial and Tax Planning from San Diego State University and she holds the CERTIFIED FINANCIAL PLANNER™ designation. She is a member of the Financial Planning Association (FPA).